Making Tax Digital - all you need to know

Starting in April 2019 UK businesses will have to file their VAT returns online

HMRC UK Making Tax Digital

UK businesses will have to file VAT returns online, starting in April 2019.

In short:

The communications with HMRC will be automated

Tax summaries are submitted through software to give HMRC an accurate view of accounts

Businesses above the VAT threshold (£85,000) will have to submit their tax returns through software

Digital finance management is becoming mandatory for everyone. If you don’t use software to manage your finances, now you have to start. Making Tax Digital will impact your work.

To help you start, we made this article with what you need to know about Making Tax Digital.

What is Making Tax Digital

Making Tax Digital (MTD) is a government plan to “make it easier for individuals and businesses to get their tax right and keep on top of their affairs”. This means the end of the annual tax return for millions. The plan aims to improve efficiency and make it easier to comply.

In 2019, you’ll submit your VAT digitally. And in 2020 the scope widens.

Businesses above the VAT threshold (£85,000) need a digital tax account. They'll also file quarterly returns online.

Every person and business will have their own

HMRC wants to

You need to start preparing now to make the transition as smooth and painless as possible.

Who does it apply to?

Making Tax Digital for Business will be in effect in April 2019 for VAT obligations. It applies to businesses and individuals.

Only businesses above the threshold will have to use the system. It includes companies, LLPs, charities and unincorporated business. The others can use it if they choose to.

This plan makes it easier for businesses to get their tax right. It builds on the already existing online filing system.

MTD for individuals

Personal tax accounts

PAYE with real-time triggers

Simple assessments

Reporting of bank interest directly from banks into personal tax accounts and simple assessments

The reported pause in MTD for individuals affects the rollout of these services to further taxpayers but it does not affect MTD for business.

MTD for business

Business tax accounts - available now

Income tax for self-assessment for sole traders, and self-employed landlords - not before 2020

VAT - April 2019

Corporation tax – not before 2020

Business tax accounts contain useful information, whilst taxpayers can access these directly, their agents can only access them through third-party software.

Source: Accounting Web

How filing your VAT returns usually works

VAT is present in every business transaction. You can account for it in different ways. Whether your customer is a business or a consumer, VAT is in every sale. Some exceptions, like sales outside of the UK,

It’s mandatory to register for VAT once your earnings pass the defined amount. Once that happens, you have 30 days to register. Keep in mind, that it can change from year to year.

After registering, you need to choose a scheme to tell how much VAT you’ve charged and VAT you’ve paid.

The usual method is to have a detailed VAT record of all purchases and sales.

Then, you’ll file with the HMRC your quarterly VAT returns.

There were other ways for you to submit your VAT returns. For example:

Annual accounting VAT scheme - instead of filing quarterly returns, you’ll do it annually. You have a deadline for reporting and to make payments.

Flat rate scheme - pay a percentage of your total turnover as

Cash accounting scheme - the VAT is accounted for on the day you’re paid, not on the day the invoice is sent.

But, after April 2019, you’ll have to file VAT returns through digital channels. This may be inconvenient, especially if you keep manual records.

You have to make sure you file your VAT returns are correct and on time. The HMRC charges fines for late submissions, payments, and incorrect information. It can also charge significant fines to businesses that don’t account for VAT correctly.

What changes with Making Tax Digital

You’ll have to keep all your financial records stored in digital format. It’ll be a lot easier for businesses that already manage their accounting with software.

If you already use accounting software, now you’ll have to file your VAT returns with it. And update the HMRC with it.

Those who manage their business’ finances manually, will have to start using

Good news is they have a few months to make the change to digital.

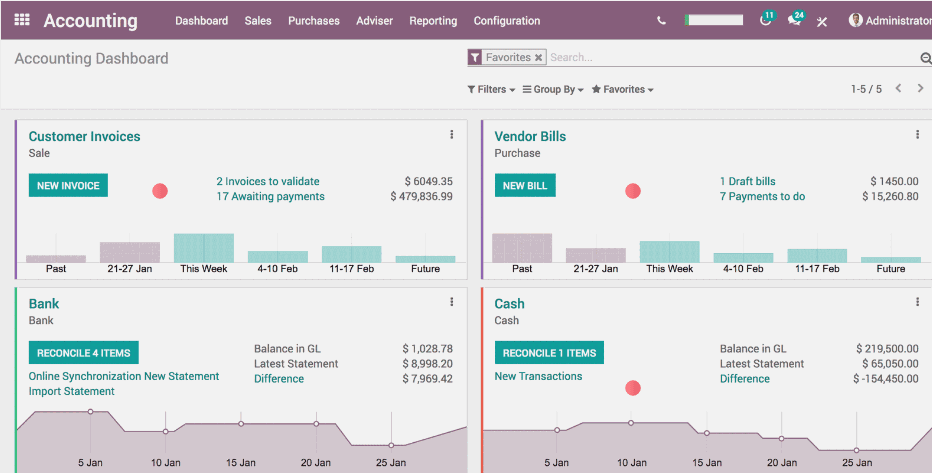

Odoo Accounting dashboard

This will help you get an overview of your finances. Know how much VAT you owe or rectify information. There advantages to this plan, according to the HMRC. The four foundations of Making Tax Digital are:

1. Better use of information - you don’t have to give information to the HMRC that it already has or can get from elsewhere (banks, employers, etc). You’ll be able to see what information the HMRC holds, see if it’s complete and correct.

2. Tax in real-time - HMRC collects and processes information that affects tax. You’ll know how much you need to pay as close to real-time as possible.

3. A single financial account - in 2020 you’ll be able to have a complete picture of your financial account.

4. Interacting digitally - you can interact with the HMRC when convenient for you.

Save for the change to digital records, VAT schemes won’t have any major changes. For example, the flat rate scheme and the annual scheme will have to turn their records digital. But, the requirements don’t change. You can see the details here.

What do I have to do to follow Making Tax Digital

Starting in April 2019, digital records are mandatory.

Whether you manage your finances in-house or have an accountant, you need to prepare. Make sure your accountant is familiar with the new rules and has the tools needed.

Ask your software provider if they’re making the necessary changes in the meantime. If you don’t use software, you’ll have to start now. Find a system that complies with the new regulations.

After it’s proven the system is working, the HMRC will widen the scope of the MTD. By April 2020, it’ll go beyond VAT for businesses.

I already have an accounting software. What does it need to be MTD compliant?

You need to contact your software provider. Ask what they’re doing to make sure you can comply with MTD.

To be in line with MTD, software needs to:

Keep and save records in a digital form

Create a VAT return from the records

Give HMRC VAT information on a voluntary basis

Receive information from HMRC via API

We are currently working on making Odoo compliant with MTD. You can ask us about it.

I don’t use software . What can I do about it?

If you manage your accounting manually, you’ll have a few months to convert to software.

First, you need to make a search for software. Try to find a system that covers your needs and follows the new regulations. Make sure your software solution can keep and preserve digital records.

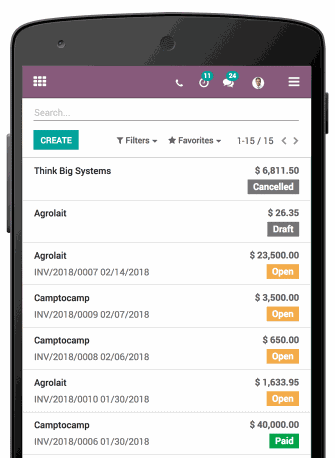

Odoo is a great solution for accounting.

Odoo accounting is equipped with features that make managing your finances easier.

It saves you time

Has automated functions

Very user-friendly

Odoo Accounting mobile app